Compliance is increasingly a defining factor for business survival.

In 2012, while working at an IT services firm, a conversation with the CIO of a major chemical manufacturer in India revealed how hard compliance had become in practice. It started as a technology discussion, then quickly turned into something fundamental. The CIO described how difficult it was for a Board to confidently say, “Yes, we are compliant.”

Not “we think we are,” not “we have policies,” but confidence across geographies, plants, and teams, backed by data. Around the same period, corporate governance expectations in India were tightening, and the direction was clear: compliance was no longer a back-office checklist. It was moving into the boardroom, and the boards wanted defensible answers.

We built a compliance management system for that client. It worked, but it was a glorified spreadsheet. It tracked tasks, but it lacked real regulatory intelligence. That’s when I realised regulatory intelligence is no longer an engineering afterthought. It is the backbone of any serious compliance program, and it requires deeper integration of legal expertise into day-to-day operations.

That early experience shaped how I think about compliance today, and it maps to three things CXOs and founders should care about: Shift, Gap, and Next.

Shift: what changed in compliance, and why it feels different now

The biggest shift is this: compliance has moved from a periodic exercise to a continuous operating requirement.

Ten to fifteen years ago, many organisations could manage compliance through quarterly reviews, manual trackers, and external advisors. That model breaks down in today’s environment for a few reasons: First, regulation is changing faster, across sectors and borders. If you operate in multiple states or countries, the “simple” act of staying up to date becomes a real operational burden. Second, boards and leadership teams are being held to a higher standard of assurance. The question is no longer “Did you do the compliance activity?” It’s “Can you prove the obligation was correctly interpreted, appropriately connected to your business, and continuously updated?” Centre compliance is now tied to business velocity. If product launches, supply chain decisions, hiring models, or market entry plans create compliance bottlenecks, the business slows down. That’s when compliance stops being a cost center and becomes either a constraint or a competitive advantage.

Building modern compliance systems is not primarily an engineering challenge. It is a law-and-operations challenge enabled by technology. The real backbone is regulatory intelligence: knowing what the law is, what changed, what it means, and who needs to act. If that intelligence is weak, the software is just a workflow for dealing with ambiguity.

That realisation also came with a practical lesson. I had an earlier attempt in the same space, and it did not work out due to differences in vision and risk appetite. It was painful, but it gave me a “last mover” advantage. I knew what fails in the real world, especially when you try to scale regulatory intelligence without the right operating model.

Gap: Where technology helps, and where it still falls short

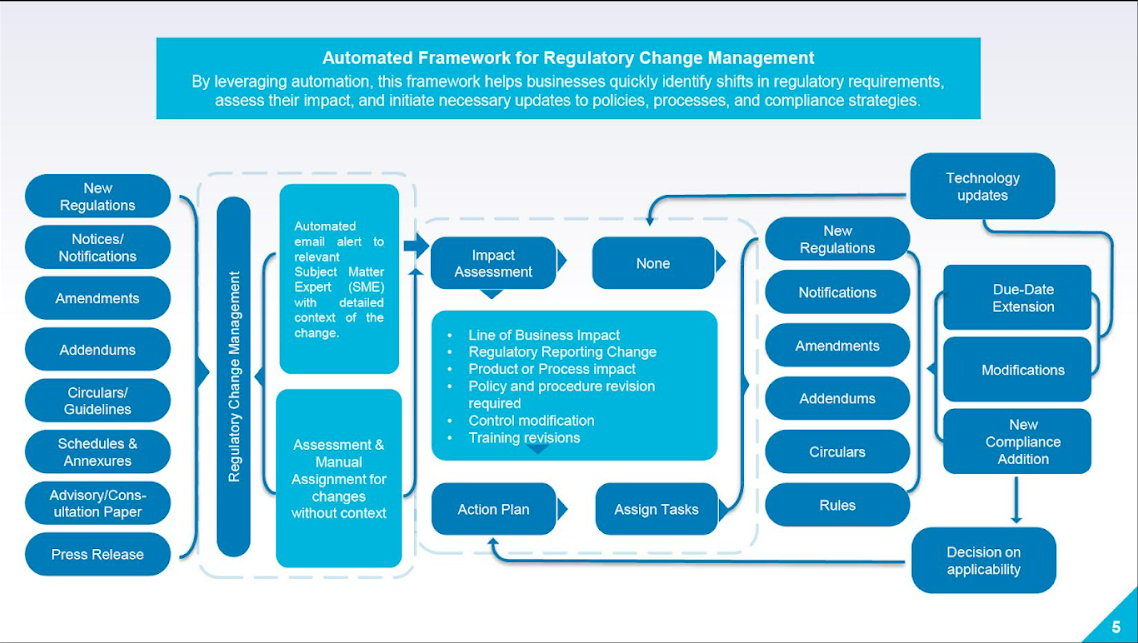

Technology has improved compliance execution. If you look up “regulatory compliance software” or “compliance management system,” you’ll find many tools that help create workflows, assign owners, track evidence, and generate reports. That’s the easy part. The harder part, where many organisations still struggle, is turning compliance into something current and trusted.

Here’s where technology genuinely helps today:

Automation of monitoring and extraction: AI can scan documents, identify relevant clauses, and summarize changes faster than humans can.

Workflow orchestration: Systems can push tasks to the right owners, enforce deadlines, and create audit trails.

Centralised reporting: Leadership can see what’s pending, what’s overdue, and what’s high-risk, without chasing updates across teams.

Now the gap, the part that still breaks in practice: Real regulatory intelligence is hard to build and harder to maintain. Most systems fail not because they can’t track tasks, but because they can’t guarantee the correctness, completeness, and timeliness of obligations across jurisdictions. If you are a CXO, this is the failure mode to watch: a system that looks “complete” on the dashboard, but is built on partial or outdated regulatory content.

The other big gap lies in the alignment of standards and real-time stakeholder interaction. Compliance spans legal, operations, EHS, finance, HR, procurement, and, at times, external partners. Even with a tool, getting all stakeholders in sync on interpretation, evidence quality, and change response is still a human and process challenge.

Finally, there is the trust question. Many compliance systems become “activity trackers,” not “assurance systems.” They show effort, not confidence. In high-stakes environments, effort is not the same as assurance.

Next: what’s coming, and what leaders should prepare for

Over the next decade, I expect compliance to shift from reactive to predictive. Today, AI helps automate monitoring and data extraction. Tomorrow, it will do more of the higher-order work: predicting the impact of regulatory change, running risk scenarios, and providing proactive guidance before obligations become enforceable. That shift matters because it changes the organisation's operating posture. Instead of asking, “What do we need to do because something changed?” leaders will increasingly ask, “What is likely to change, and how do we design the business to stay compliant by default?”

This is where we’ll see three structural changes:

The role of compliance professionals will move up the value chain. Routine tasks like tracking, documenting, and updating will be increasingly automated. Human expertise will centre on strategic interpretation, ethical governance, and policy-level decision support.

Reg-Tech platforms will become mission-critical infrastructure. Just as organisations depend on ERP systems for finance and operations, they will depend on compliance ecosystems that integrate regulations, workflows, audits, and reporting into a single digital layer. If you have ever searched for “enterprise compliance platform,” you already see where the market is going.

“Compliance-by-design” will become the default expectation. Regulatory requirements will be embedded into business processes and technology from the start, rather than added as an afterthought. Organisations that treat compliance as a design constraint from the start will move faster later.

A 2026 operator view: what building in this space teaches you

Over the years, I have learnt how to create successful B2B SaaS or Technology offerings, and I want to share what I’ve learnt with anyone building in this domain. “Your enterprise client is not looking at flashy features. They want a partner who understands or is interested in understanding their business as much as they do. You are expected to be a master in your domain, not just the technology. The client also wants you to take ownership of creating success stories for their implementation.

To achieve this, you just can’t rely on a single skill; you need to build a team that masters technology, domain expertise, business, storytelling, customer orientation, HR, etc. Don’t stop at being passionate about your product or service; be equally passionate about creating success for your partners, people, and clients, and be part of their stories.

Your story may be heard just once, yet the stories you help create can echo a thousand times over.